carbon tax benefits and disadvantages

The Pros of Carbon Offsetting. 14 Advantages and Disadvantages of Carbon Tax.

Carbon Tax Pros And Cons Economics Help

Emissions but would have only a modest effect on the Earths climate without a worldwide effort.

. Effects of a Carbon Tax on the Economy and the Environment. The carbon tax can be regarded as the price for one unit of carbon that is emitted into our atmosphere. One of the most common announcements one hears from companies looking to improve their environmental impact is the decision to become carbon neutral often through carbon offsets.

A carbon taxs effect on the economy depends on how lawmakers would use revenues generated by the tax. A carbon tax is paid for by the people who use the fuel. A carbon tax might lead me to insulate my home or refrain from heating under-occupied rooms thus reducing emissions at a lower cost than by using expensive electricity generated from green sources.

One advantage of a carbon tax would be higher emission reductions than from other policies at the same price. A carbon tax could replace many such inefficient environmental and energy policies. The first carbon tax implemented by.

This process makes the dirtier fuels more expensive to use encouraging everyone to reduce consumption increase efficiencies or. Lawmakers could increase federal revenues and encourage. Plus some conservatives may be attracted to a carbon tax as an alternative to more EPA regulations.

She suggests that a carbon tax would reduce the buildup of greenhouse gasses replace. It helps environmental projects that cant secure funding on their own and it gives businesses increased opportunity to reduce their carbon footprint. Disadvantages of the Carbon Tax Negatively affect the Queensland Tourism Industry.

A carbon tax of P2-P0 would raise the price to P2 and cause a more socially efficient level of output. In theory the tax will reduce pollution and encourage more environmentally friendly alternatives. Although the carbon tax has some important advantages it also implies some problems.

However critics argue a tax on carbon will increase costs for business and reduce levels of investment and economic growth. A carbon tax can have a positive effect on the local economy. Governments set a price per ton on carbon which translates into taxes on oil natural gas and electricity.

Whats worse if sufficient funds were not available at their disposal. The market price is P1 but this ignores the external cost of pollution. A carbon tax aims to make individuals and firms pay the full social cost of carbon pollution.

The government then returns some of the funds collected from the Carbon Tax to the most deserving consumers. One of the advantages of using carbon tax is that it represents a quantifiable source of revenue generation that can be controlled by government along with providing an incentive to avoid the tax by reducing emissions. A carbon tax also has one key advantage.

It imposes expensive administration costs. It could start a race for lower emissions technologies which would give energy companies an edge on competitors. A carbon tax could force businesses and citizens to cut back carbon-intensive services and goods.

Reuters - The voluntary carbon offset credit market has the potential to play a. A carbon tax can be very simple. A carbon tax provides certainty about the price but little certainty about the amount of emissions reductions.

Advantages of Carbon Taxes. It levies fess on the production or distribution of fossil fuels and the people or agencies who use them. It is easier and quicker for governments to implement.

Up to 24 cash back List of Disadvantages of Carbon Tax 1. Studiesincluding those coming from carbon tax proponentscarbon taxes slow economic growth unless a large portion of the tax revenue is allocated to corporate tax reductions. Many companies cant reduce their emissions as much as theyd like to.

You can get out of a carbon tax by switching to renewable or alternative fuels for your. Negative net social benefits. Adele Morris proposes a carbon tax as a new source of revenue that could also help address climate change.

There are three big problems with the concept. Carbon offsetting has benefits at both ends of the process. Tax on carbon will induce firmsplants to push for green production processes in addition to raising revenue which can be used to promote environment-friendly initiatives.

However there is a view that industrial units may shift to countries with lower or no carbon taxes. Recognized the need for biodiversity co-benefits REDD means that forest carbon now has a value. The tax would help reduce US.

Its an appealing idea but one that can be inordinately complicated as any company that has undergone this process can. The carbon tax can be really expensive considering that the government would need a substantial amount of money for its implementation. Carbon taxes have been suggested as a way to internalise the negative externality of carbon emissions.

Carbon offset credits and their pros and cons. It is a form of carbon pricing and aims to reduce global carbon emissions in order to mitigate the global warming issue. Ad Calculate your carbon footprint in just 5 minutes and receive tips on how to reduce it.

Therefore they are not affected by the increase in prices. The Proposal This paper proposes a tax starting at 16 per ton of CO 2-. The Benefits and Drawbacks of Carbon Offsets.

Proponents claim that a carbon tax would be the most cost-effective way to cut carbon-dioxide emissions. A fun test about a serious issue. The carbon tax is a method of taxing pollution.

Those deserving consumers are selected using a minimum income threshold. But the carbon tax keeps running aground. Benefits beyond a safeguarded baseline is Whereas carbon stored in forests had virtually no considerably more ambiguous as well.

However while Carbon credits more important than local the need for biodiversity safeguards is widely communities.

27 Main Pros Cons Of Carbon Taxes E C

Key Advantages And Disadvantages Of Alternative Marine Fuels Download Scientific Diagram

14 Advantages And Disadvantages Of Carbon Tax Vittana Org

Carbon Tax Pros And Cons Economics Help

Carbon Tax Pros And Cons Is Carbon Pricing The Right Policy To Implement Earth Org Past Present Future

Carbon Tax What Are The Pros And Cons Climateaction

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/NQJIAO7FVFDQDLOXADS34CHSXM.JPG)

The Pros And Cons Of Market Based Environmental Policies By Kenneth Andres Medium

8 Pros And Cons Of Carbon Tax Brandongaille Com

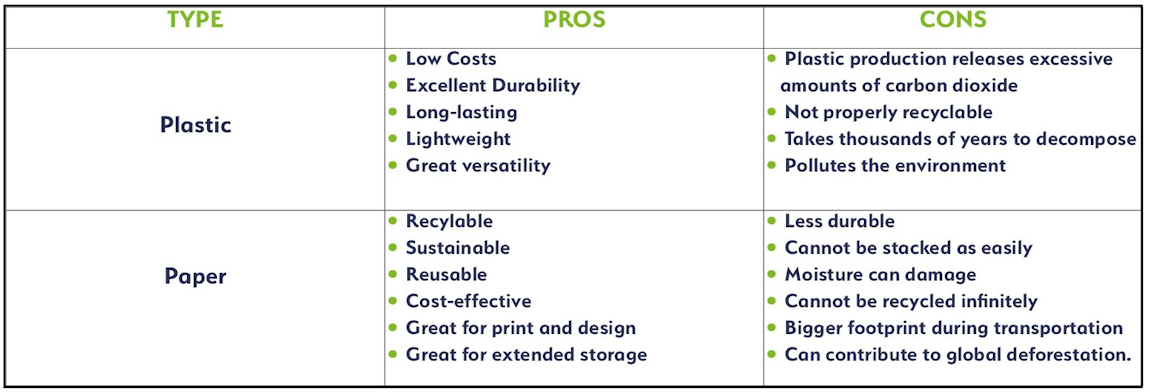

Plastic Vs Paper Packaging The Pros And Cons

/GettyImages-97615566-5b58f1ddc9e77c00713cdd3c.jpg)

Carbon Tax Definition How It Works Pros Cons

Advantages And Disadvantages Of Multiple And Single Sourcing Strategy Download Table

18 Advantages And Disadvantages Of The Carbon Tax Futureofworking Com

14 Advantages And Disadvantages Of Carbon Tax Vittana Org

Carbon Tax Pros And Cons Economics Help

Carbon Tax Advantages And Disadvantages Economics Help